The art market in 2025 feels both futuristic and nostalgic, a year defined by artificial intelligence collaborations, immersive installations and a renewed respect for traditional craftsmanship. While digital art and generative technologies continue to make headlines, the clearest signals of value are coming from the auction houses, where blue-chip names are proving their lasting strength. Among them, David Hockney remains a standout. The recent Phillips auction results confirm not only his enduring appeal but also wider trends shaping the global art market this year.

Collectors in 2025 are rediscovering the reliability of established artists. At the recent Phillips London Editions sale, Hockney works performed well above expectations. Tyler Dining Room, from Moving Focus (1984) sold for £90,300 against an estimate of £40,000–£60,000, and the sale achieved a 95 per cent sell through rate. This result reflects a broader collector mood: confidence in the familiar.

Tyler Dining Room, from Moving Focus (1984)

1. Buyers are prioritising proven markets, strong provenance and cultural longevity. In this context, Hockney represents an excellent prospect. His art combines recognisable imagery with institutional validation, making it attractive to both collectors and investors seeking a degree of certainty.

2. One of the defining characteristics of today’s market is its layered structure. Collectors no longer view art solely as the preserve of the ultra wealthy. While top tier Hockney paintings continue to command multi million pound figures, his prints and lithographs provide accessible entry points for new buyers.

3. This reflects a broader trend across 2025: the democratisation of collecting. Smaller works and editions have become key components of diversified art portfolios, allowing participation at different price levels. Hockney’s prolific printmaking ensures supply, yet his enduring popularity maintains healthy demand, balancing accessibility with potential for appreciation.

David Hockney. Credit: Dan Kitwood/Getty Images

4. The most successful artists of 2025 are those who embrace experimentation, and Hockney’s versatility keeps him firmly at the forefront. His ability to work fluidly across painting, photography, printmaking and digital drawing ensures continued relevance. The market’s interest in his iPad drawings and digital prints demonstrates that innovation does not undermine value when it is grounded in genuine artistry.

5. Museum exhibitions and retrospectives remain powerful influences on market confidence. Hockney’s ongoing recognition by major institutions, including his 2025 Paris retrospective, amplifies demand. Auction results tend to rise around such moments of visibility, as both public attention and collector enthusiasm increase. For investors, understanding this relationship between institutional exposure and market performance is essential.

The 2025 art market may be increasingly digital and global, but its underlying values remain unchanged: originality, authenticity and enduring vision. David Hockney embodies all three. His consistent auction performance, creative adaptability and blue chip status make him one of the most reliable names in contemporary collecting. Whether one is acquiring a major painting or an editioned print, Hockney represents a blend of aesthetic satisfaction and long term market strength.

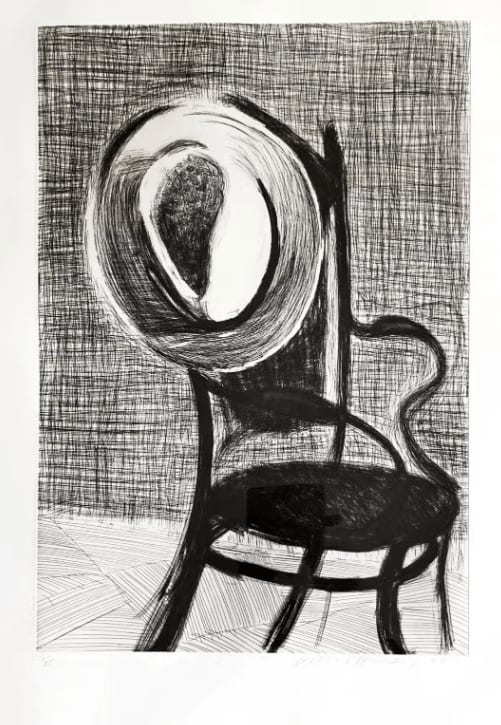

Hat on Chair, 1988

Contact one of our consultants today to discover the David Hockney works we currently have on offer.

Sources:

Phillips London Editions Sale Results, 2025

Financial Times, “Christie’s to sell rare £50m Hockney portrait of Christopher Isherwood”, October 2025

The Guardian, “David Hockney iPad drawings of Yorkshire Wolds to be sold at auction”, October 2025

Artprice, Art Market Report 2025

Disclaimer

Investing in art carries inherent risks. Values can rise or fall, and past performance should never be taken as a guarantee of future results. Liquidity cannot be assured, and fees, terms and conditions may apply. We strongly recommend seeking independent financial or professional advice before making any purchase.Amber Galleries is not regulated by the Financial Conduct Authority and is not authorised to provide investment advice, whether for regulated or unregulated assets. The content provided in this document is for general informational purposes only and should not be relied upon as the sole basis for any investment decision.While Amber Galleries, including its affiliates, officers, directors and employees, endeavours to ensure the accuracy and completeness of the information provided, it makes no representation or warranty of any kind and accepts no liability for any errors, omissions or inaccuracies. All decisions made based on this information are taken at the buyer’s own risk.